Raw Materials 2030:

A Lasting Recipe for European Resilience

Our 2030 trajectory is clear: The Critical Raw Materials Act sets ambitious goals for Europe to grow its metals resilience to supply the energy transition. Now, of course, the challenge is delivering on this, and with speed.

We have an achievable, six-part recipe for metals resilience, mapping out what concretely needs to happen before 2030 to really shape Europe’s success.

Europe’s metals industry is ready to deliver this success: We’ve got a rich existing industrial base and over 70 supply chain projects.

Yet we’re not the only cooks around. We’re currently facing an ever-larger competitiveness gap with other regions who have so far better equipped their companies for success. Our industrial ambitions are at risk.

Opening New Capacity

Taking a quantum leap forward

Despite a growing project pipeline, we have opened no mines in the last 15 years, and only a handful of refining and recycling plants.

Europe needs to open a minimum of:

mines

processing facilities

recycling facilities

for key strategic raw materials - with high sustainability performance

Reviving Production

Restoring our strong industrial base

Europe alread has a vibrant metals industry, but we've been hit hard by the energy crisis, with 50% of our aluminium, zinc, and silicon production switched off today

Europe needs to bring back online:

+

+

+

+

Maximising Re-cycling

Managing our waste locally and well

Today, we're on track to have the recycling capacity weneed, yet leakage of our metals waste is still too high

Europe needs to ensure a:

increase in recycling's supply contribution, per material wherever feasible, through collection, sorting, shipment improvement.

Securing Global Supply

Funding for the partnerships we need

Today, in contrast with our global competition, the EU funds no raw materials projects in reosource-rich third countries.

Europe needs to fund up to:

third-country raw materials-related projects through the Global Gateway programme or other tools on the basis of priority strategic partnerships and a robust trade strategy.

Greening Electricity

Providing access to abundant, decarbonised electricity

Metals in Europe's most electrified industry, yet currently misses the decarbonised electricity it needs.

Europe needs to supply:

to its strategic raw materials supply chains

(The equivalent to the Netherlands' annual consumption)

Increasing Skills

Training and attracting skilled workers to bridge the skills gap

If we continue on our current course, we'll face a critical shortage of skilled workers

Europe needs to train:

of new workers with the right skills.

from geologists to metallurgists to engineers

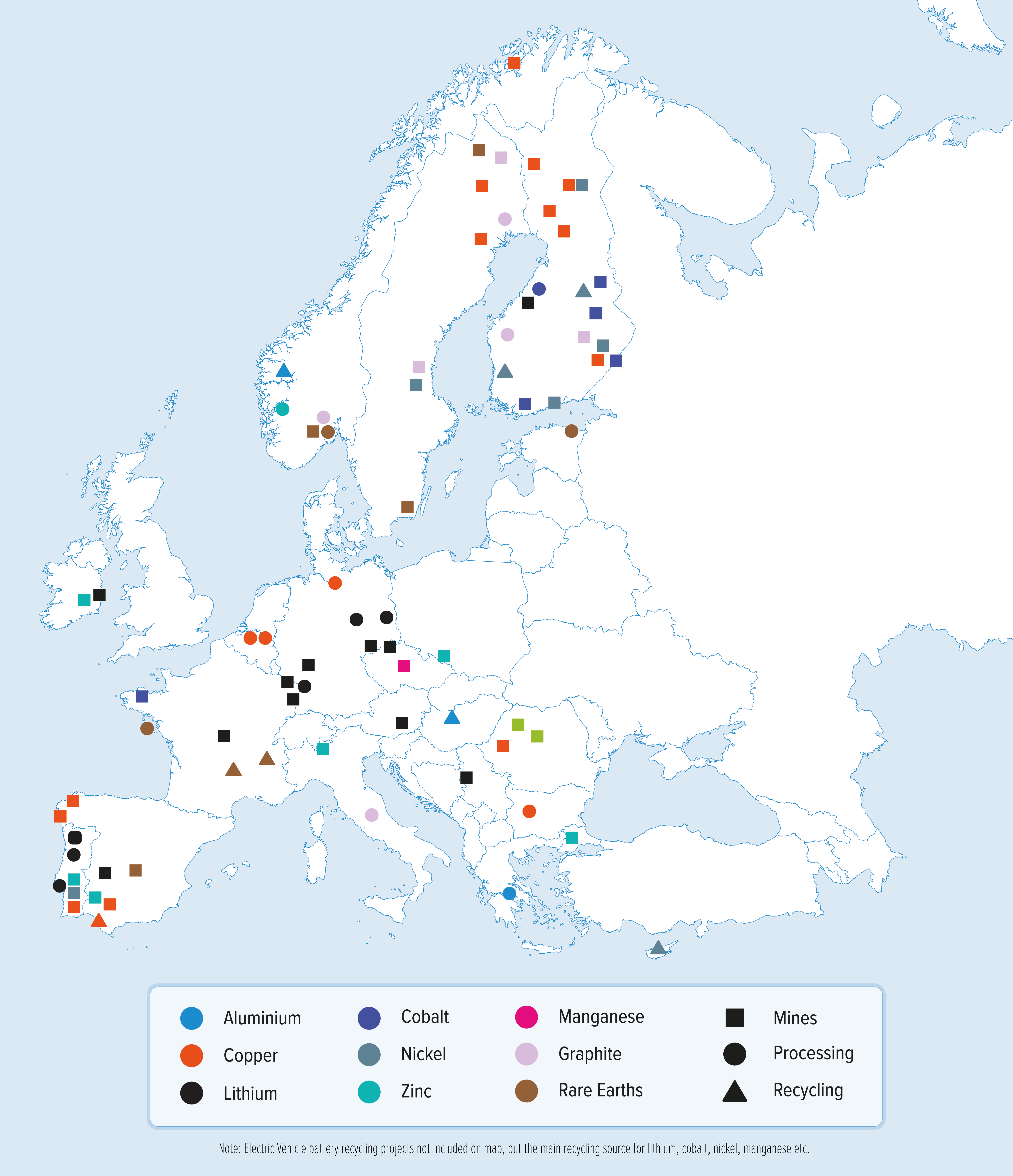

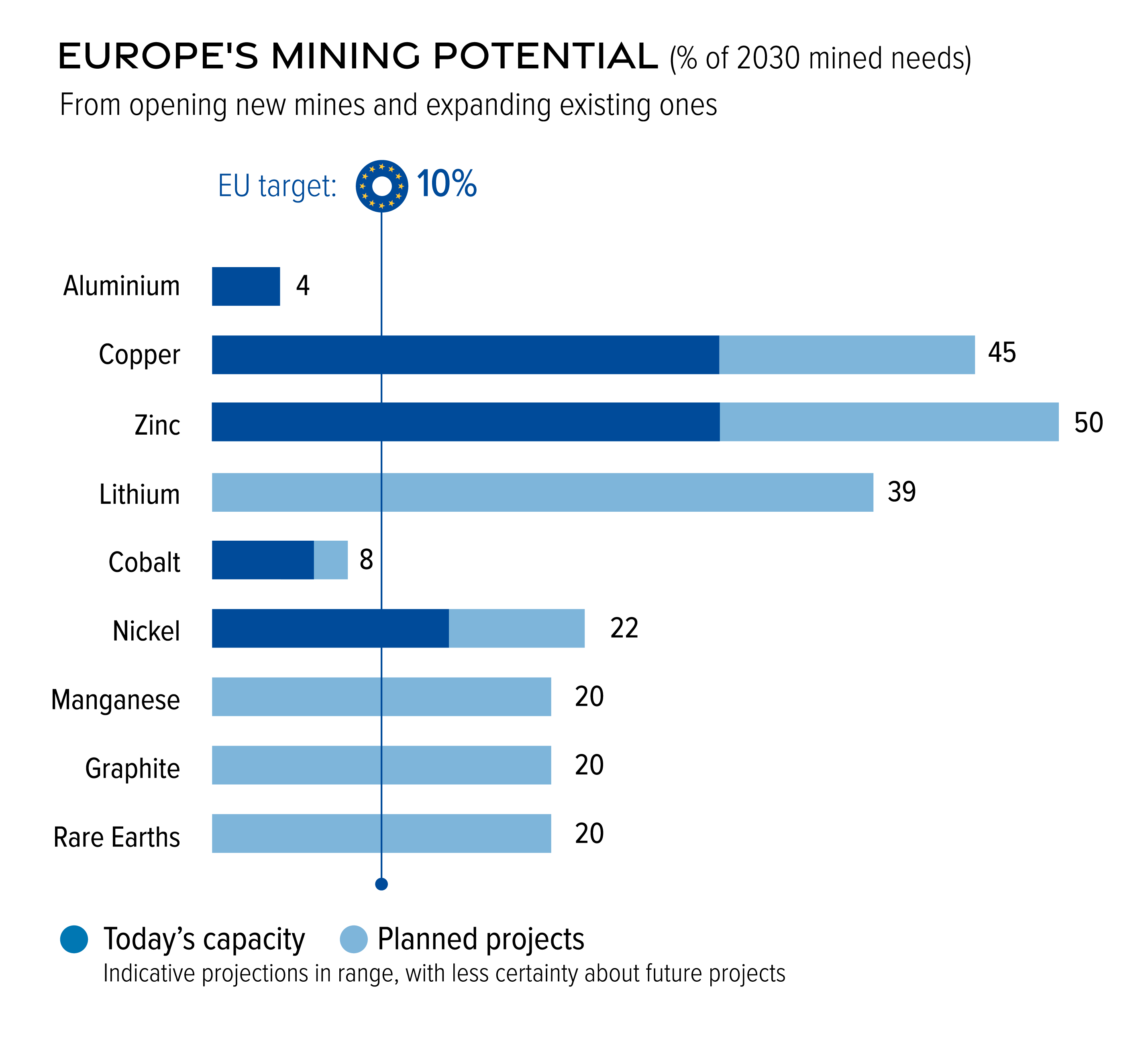

Resilience potential:

Europe’s 2030 raw materials project pipeline

Through securing final investments and reviving production, Europe can meet some or all of its Critical Raw Materials Act benchmarks for aluminium, cobalt, copper, lithium, nickel, and silicon. More projects are still needed for EU 2030 goals, especially for midstream refining, e.g. graphite, manganese, gallium, germanium, magnesium, rare earths.

For some critical metals, like platinum group metals, Europe only needs to strengthen the strong base and trade links it already has. A thriving metals ecosystem will ensure Europe’s resilience not only for the metals designated as strategic or critical, but also all those others necessary for our transitioning economy - from zinc to lead to silver.

Urgency:

An Industrial Deal, Led By An Executive Vice President

Introducing an EU Industrial Deal by June 2025 means we’ll have fewer than 1,700 days to reach our 2030 raw materials and clean tech targets.

Urgency: Europe simply can’t afford to wait a single day longer to put in place a robust EU Industrial Deal led by an Executive Vice President, with a top-down policy agenda implemented across all Directorate Generals.

A truly ambitious EU Industrial Deal means creating a ‘European kitchen’ that rivals the world. This ‘European industrial kitchen’ needs five central components to lead the way.

Globally Competitive Energy

- Why?

- Europe’s clean supply chain goals will require new and simplified EU-level finance to compete against the US IRA and other global programmes.

- How?

-

- Deliver a Sovereignty Fund for manufacturing, including a strong raw materials focus, capable of rivalling our global competitors.

- Set up a Raw Materials Bank inspired by the Hydrogen Bank, which provides time-limited output-based support, applicable both to operating and capital costs of strategic projects.

- Introduce a new package of State Aid guidelines focused on OPEX as well as CAPEX, including scaling-up critical raw material production, emission reduction projects, and facilitating consumption of decarbonised electricity.

New EU-Level Finance

- Why?

- European investment and competitiveness requires real action to address today’s ongoing high energy prices, especially for the electricity-intensive raw materials supply.

- How?

-

- Massively accelerate the roll-out of low-carbon, renewable and nuclear energy capacity, including removing barriers to renewables power purchase agreements and their uptake by by electricity-intensive industries (e.g. shaping and firming costs)

- Create a bridging solution for keeping electricity-intensive industries viable while power prices remain high, building on the different national support actions from the last two years.

- Preserve the Emissions Trading System indirect cost compensation scheme until at least 2030, to partially offset the ETS’s increase to electricity costs, even when consuming decarbonized electricity.

Regulatory Alignment

- Why?

- Europe’s CEOs this year ranked Europe’s regulatory complexity and incoherence as its biggest competitiveness barrier.

- How?

-

- Deliver an overall proposal for measures to eliminate contradictions and unnecessary complexity in existing EU legislation.

- Add a clearer focus on investment predictability into Europe’s chemicals policy and other upcoming waste/product legislation, while streamlining the implementation of the Green Deal’s existing policies.

- Apply caution in the introduction of the Carbon Border Adjustment Mechanism, making sure that the mechanism is capable of working as intended, keeping a level playing field for European producers and avoiding excessive costs.

- Apply a systematic competitiveness stress test against which each new policy should be evaluated, including all pieces of legislation awaiting implementation.

Assertive Trade Agenda

- Why?

- As geopolitical tensions escalate, Europe needs to secure its place in the new global order, especially for responsible securing critical raw materials.

- How?

-

- Strengthen the use of EU trade defence measures to address proven global distortions in raw materials supply chains, including faster protection for those most at risk of dumping – as well as other trade policy tools

- Launch a dedicated Global Gateway raw materials investment plan for financing overseas projects, backed by the European Investment Bank, export credit agencies, development finance institutions, and others.

- Act further to keep strategic raw materials recycled in Europe - especially through the right classification and shipment facilitation for emerging waste streams like battery black mass.

Market Incentives

- Why?

- Europe needs to incentivise its downstream industries to buy higher cost low-carbon and local materials, especially those strategic raw materials most vulnerable to global pricing shifts.

- How?

-

- Publish a dedicated strategy on low-carbon products, using evidence-based methodologies for lifecycle carbon accounting

- Evaluate the use of Contracts for Difference to ensure stability for prospective producers of specific critical raw materials which are the most vulnerable to global pricing distortions from China’s market dominance

- Propose VAT exemptions or other market incentives for products supplied with low-carbon materials and/or locally-produced strategic raw materials.